We are a cost accountant firm & offer consultancy services all over India. We have a versatile philosophy towards our work with the whole sole aim being the customer satisfaction.

Cost Audit of Cost Accounting Records maintained by company in pursuance of section 148(2) of the Companies Act, 2013 for ascertains the accuracy of cost accounting records to ensure that they are in conformity with Cost Auditing Standards (CAdS) issued by The Institute of Cost Accountants of India; to the extent these are relevant and applicable Cost Accounting Standards and Generally Accepted Cost Accounting Principles (GACAP) notified by The Institute of Cost Accountants of India. Government of India, Ministry of Corporate Affairs has notified the Companies (Cost Records and Audit Rules) 2014.

Cost Accounting Records maintained by company in pursuance of section 148(1) of the Companies Act, 2013, provides for mandatory maintenance of Cost Records in case of certain companies related to production and services sectors. We provide the Guidance for Maintenance of Cost Accounting Records prescribed as per rule 5 of The Companies (Cost Record and Audit) Rules 2014 and Certification as regards maintenance of Cost Records by the Company. We are amongst the top firms of the market engaged in offering customized solutions with respect to cost management & cost consulting services to the clients.

Section 35(5) of CGST Act 2017, every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a cost accountant or a chartered accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed.

Sec 44(2) is saying regarding reconciliation statement. It says, every registered person who is required to get his accounts audited in accordance with the provisions of sub-section (5) of section 35 shall furnish, electronically, the annual return under sub-section (1) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement, and such other particulars as may be prescribed.

We offer GST consultancy services for companies looking to set up operations in India. We are also rendering GST Registration Service, GST Returns and other compliance services etc.

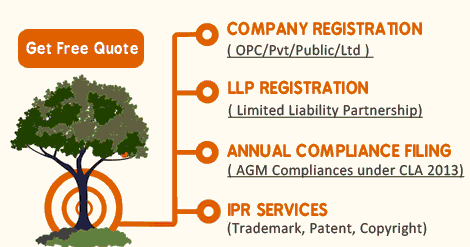

We offer solutions for all client's needs, help in setting up the business and help the company make a place for itself in the booming market.

We help our clients to maintain & file MCA Compliance services within the time limit prescribed under Company Act 2013.

We provide management audit & consultancy services in India to cost reduction and cost control, optimizing resources, capacities utilisation, laying business plans & developing relevant MIS for decision making.

We help our clients who want to file their income tax return for reporting their income for a financial year, guide them to saving maximum taxes, carrying forward losses, claiming income tax refunds.